Overview

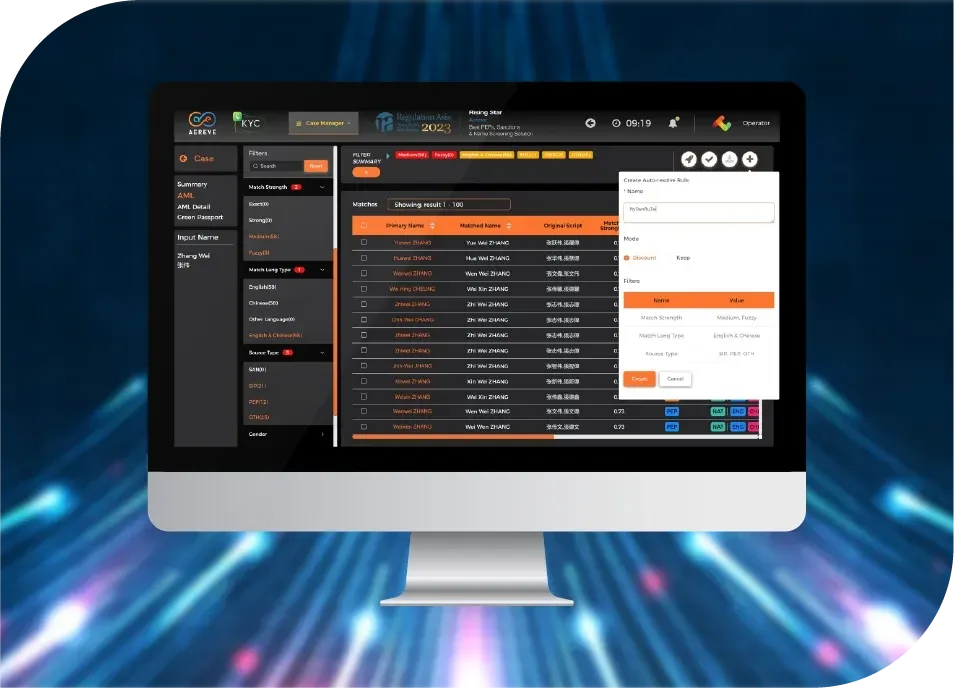

Effective anti-money laundering and combating the financing of terrorism policies are key to the stability of the international financial system. If a new AML screening system is needed, E2RegTech.aaS offers primary screening, an innovative approach integrates anti-money laundering (AML), know your customer (KYC), and combating the financing of terrorism (CFT) regulations and processes, to handle original and translated names in Asian countries and other non-Latin character-based regions. While English names are given priority, we recognized that western-centric solutions might mishandle translated Chinese names. Furthermore, certain non-Latin characters can undergo screening in their original script without necessitating translations. Those seeking a name screening system with enhanced analytics for Japanese, Chinese, Korean, and other non-Latin languages will find E2RegTech.aaS a suitable solution. In situation where transitions to a new screening system proves challenging and costly, yet difficulties persist regarding noise, false positives, false negatives, and the inability to recognize Asian characters, E2RegTech.aaS is equipped with multi-language smart alert discounting, automation capabilities, and flexible rule creation. Additionally, supplementary support for investigating alerts through advanced KYC analytics like adverse media news, social media analysis, holistic google search analytics, OCR, and voice-to-text conversion are also offered. The blended language capability offers an "East meets West" solution to enhance overall AML and KYC processes. Moreover, providing a health check and assessment solution to refine existing screening system so as to enhancing the screening efficiency.

Features

Platform

Benefits

- Google Search Analytics: Gain valuable insights into customer counterparties using comprehensive Google search data.

- Explainable Rule-based Audit Trail and Natural Language Processing Analytics: Ensure transparency and compliance in risk assessment processes.

- AML Screening Test/Health Check: Proactively assess the efficacy of your AML screening system and receive threshold and alert discount suggestions.

- Sandbox Testing: Create bespoke test scripts to fine-tune screening system settings and optimize performance.

- Primary Screening: Specializes in blended Chinese and English AML screening natively, ensuring accurate identification of potential risks.

- Expertise in Local Non-Latin Characters: Effectively screen traditional and simplified Chinese characters, enabling comprehensive coverage.

- Adverse Media News and Social Media Analysis: Identify potential risks and negative information from local non-Latin sources.

- Rising Star for Best Sanctions and PEP Name Screening Solution: Recognized by Regulation Asia during the Singapore Fintech Festival 2023.

Pricing